AI משנה את הכל -

גם את הפנסיה

וההשקעות שלך.

מי אנחנו

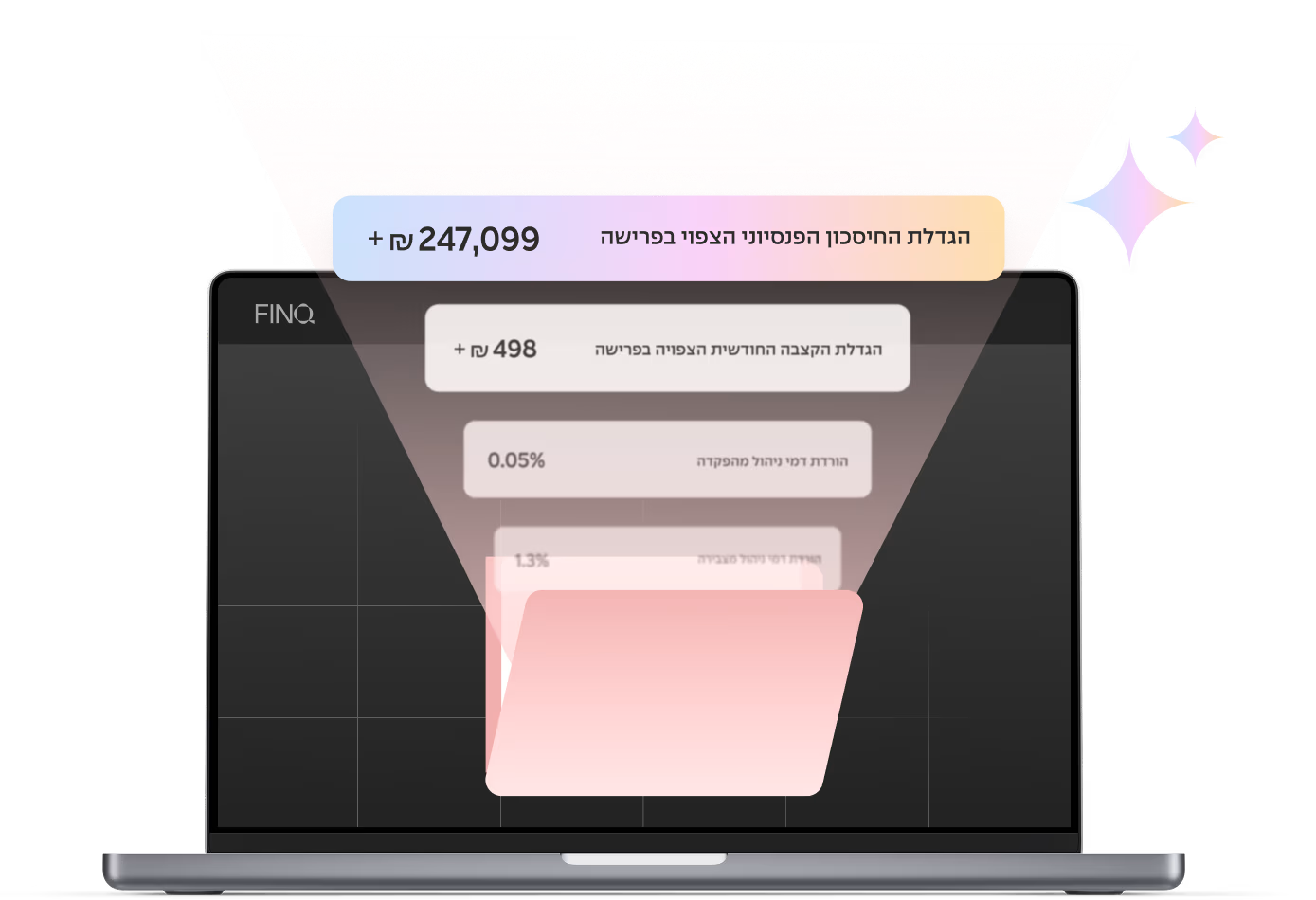

FINQ היא חברת טכנולוגיה פיננסית מהדור הבא, שפועלת מתוך חזון להנגיש שירותי השקעה וניהול פנסיה מתקדמים לכל אדם - לא רק למוסדיים או לבעלי הון. הטכנולוגיה של FINQ משלבת מומחיות

עמוקה בשווקים הפיננסיים עם AI מתקדם, מאפשרת קבלת

החלטות חכמות, שקופות ואובייקטיביות.

המנוע שפיתחנו סורק ומנתח באופן רציף כמויות עצומות של מידע

פיננסי, ובונה מוצרים שמבוססים על נתונים אמיתיים -

לא על דעות או אינטרסים.

המשימה שלנו

אנחנו ב-FINQ מאמינים בשוק פתוח, שוויוני ומבוסס מדע.

המשימה שלנו היא לאפשר לכל אדם ליהנות משירותים פיננסיים שבעבר היו שמורים רק למקצוענים - ולהפוך את ניהול הפנסיה וההשקעות לפשוט, חכם ושקוף.

הפאונדרים שלנו

אלדד תמיר, מייסד ומנכ"ל FINQ, איש השקעות ותיק שהקדיש את הקריירה שלו לחדשנות פיננסית ולפתיחת השוק לציבור הרחב.

אליו הצטרף ניר צוק, מחלוצי הסייבר בעולם ומייסד פאלו אלטו נטוורקס, שמביא את עולמות הבינה המלאכותית והטכנולוגיה לעולם ההשקעות. יחד, הם משלבים ניסיון פיננסי, טכנולוגי וערכי - ליצירת

פלטפורמה שמציבה את האדם במרכז.

הנוכחות הגלובלית שלנו

FINQ פועלת תחת רישוי רגולטורי מלא בישראל ובארצות הברית. בישראל, החברה מפעילה מערך דיגיטלי שלם לשירותי פנסיה והשקעות מבוססי AI. בארה"ב, החברה פועלת תחת רישיון RIA של ה-SEC, ומנהלת קרנות סל חכמות וקרנות נאמנות מבוססות AI.

why_it_matters.title

why_it_matters.problem.title

why_it_matters.problem.description

why_it_matters.solution.title

why_it_matters.solution.description